2024 Trends in Printed Electronics

The printed electronics landscape has seen substantial growth in recent years and there’s no sign of it slowing down. In 2023, the global printed electronics market size by material and substrate reached 13.1 billion USD. The healthcare/wellness and automotive sectors dominated the market, fueled by various applications ranging from in-mold touch sensing to wearable glucose test strips.

As 2024 kicks off, the forecast for the printed electronics market is showing promising growth — supporting well established sectors like conductive inks while also shining light on emerging use cases like in-mold electronics. These trends serve as an indicator of how closely the next generation of electronics will integrate with our daily lives.

Let's take a closer look at where the market is headed.

Printed electronics market size

According to StartUs Insights printed electronics is forecasted to rank as the sixth most impactful trend in electronics manufacturing in 2024.

Individually, the market for printed electronics is projected to grow at a compound annual growth rate (CAGR) of approximately 19% between 2024 and 2033. By the end of 2024, the market is projected to reach a total value of over 15 billion USD.

What are the market drivers in printed electronics?

A number of market drivers contribute to the predicted growth rate of printed electronics. These include:

- Conductive inks: Being the most critical component of printed electronics applications, continued investment in conductive inks will enable cost-effective production of lightweight and flexible electronics.

- Substrates: Equally as important as conductive inks, the rise in lightweight, flexible, and stretchable applications will also result in increased demand for materials to print on.

- RFID technology: As retail tracking and data communication continues to expand, RFID technology will grow in tandem, particularly with regards to opportunities in smart packaging. Grand View Research expects this technology to realize the fastest CAGR from 2022 to 2030.

- The Internet of things (IoT): Forbes projected that by the end of 2024, over 200 billion IoT devices, ranging from toys to appliances, will be connected online. With the form factors of electronics rapidly evolving, it’s expected that IoT devices will help drive global adoption of printed electronics.

- Flexible and stretchable electronics:

- Displays: With applications in consumer electronics and automotive dashboards, displays hold the highest market share at over 38%.

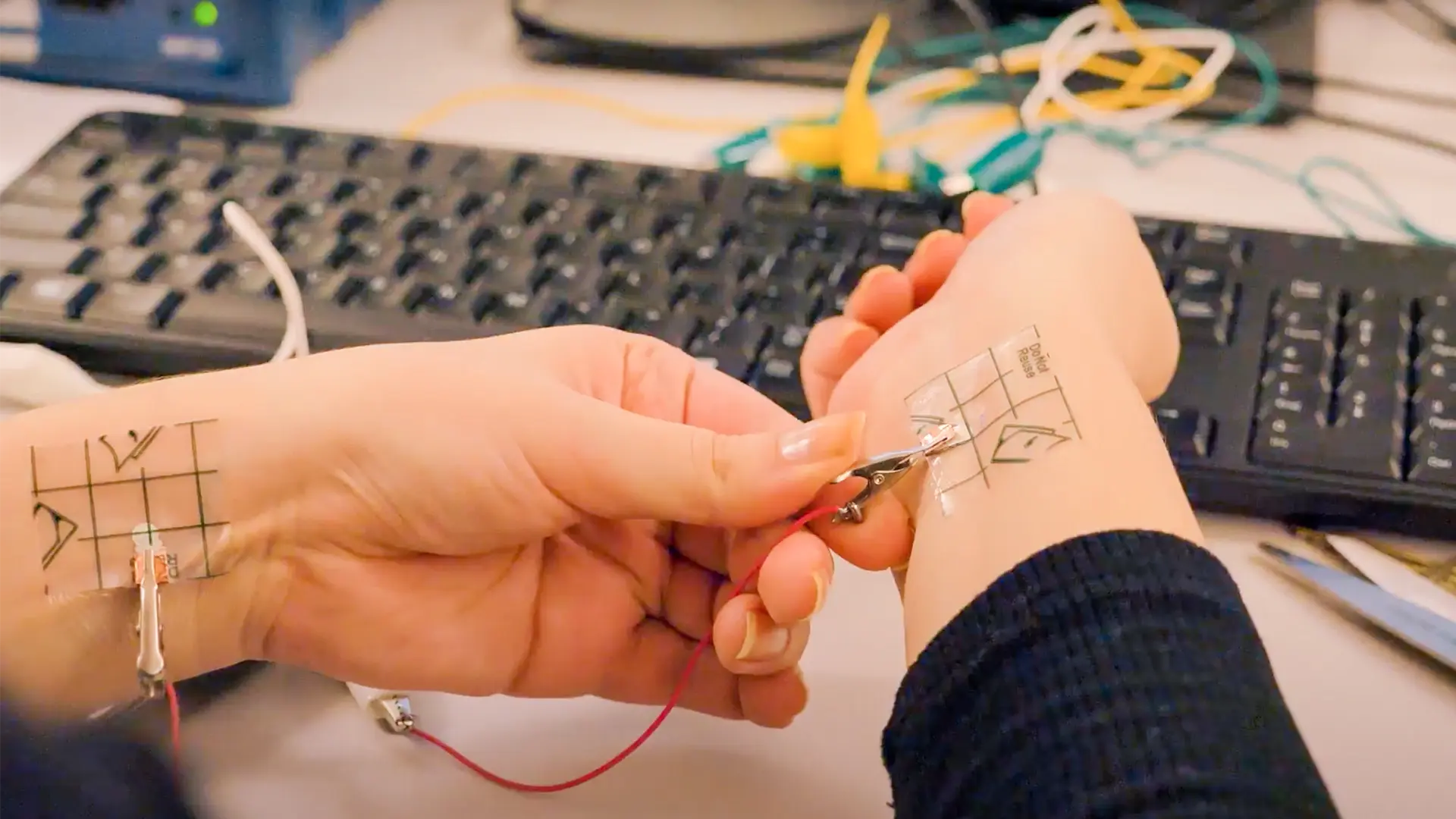

- Sensors: Innovations in healthcare, environmental monitoring, industrial automation, and wearables can be attributed to the continued growth of sensors.

- Photovoltaics (PV): Within the energy sector, flexible PVs are predicted to gain large traction primarily driven by integration with buildings.

We can clearly see the dominance of conductive inks in printed electronics displayed in this data. Flexible substrates, though not as dominant as conductive inks, are still projecting growth in the global market up to 2033.

Where is the largest market for printed electronics?

According to Market.US, who analyzes the regional trends and market drivers that make up this industry’s global landscape, the largest markets for printed electronics are:

- Asia-Pacific (APAC): This region represents the largest market for printed electronics adoption. This can be attributed to a robust electronics manufacturing hub created by key market players like Samsung Display, LG Display CO. Ltd., and E Ink Holdings. Furthermore, the APAC region’s economic growth in major countries like China, Japan, and South Korea, fuels investment in the printed electronics sector.

- North America: Shortly behind APAC comes North America. Their demand for printed electronics primarily focuses on research and development in sectors like healthcare, aerospace, and defense. Some key market players in this region include NextFlex, Flex Ltd, and Molex LLC.

- Europe: Renowned for innovation and sustainability, European countries like Germany are projected to continue increasing research and development in advanced consumer electronics and automotive displays, due to the demand for electric vehicles and eco-friendly electronics.

- South America: A smaller market, countries like Brazil and Mexico are fueled by a younger demographic's interest towards technology and innovation.

- Middle East and Africa: The smallest market, this region mainly focuses on technological infrastructure and educational advancement.

Printed electronics technology

In the same report mentioned above by Grand View Research, this following graph segments the printed electronics market by technology.

Screen printing represents the largest share of the market by technology, holding over 64% of total revenue. Inkjet is close behind, followed by flexographic and gravure printing technology. While not listed, direct ink write dispensing is gaining momentum in the industry for its affordability, accuracy, and low cleaning requirements.

Conclusion

These factors serve as a general indicator of where the printed electronics market is headed for 2024 and beyond. However, the industry’s potential isn’t limited to only a few trends. Whether it’s the digital dashboards transforming automobile interior design, or cellular smart labels revolutionizing shipment tracking for both sender and receiver, these trends will inspire confidence for industry innovators worldwide.

Check out our Customer Stories

Take a closer look at what our customers are doing in the industry.